Global decarbonization faces multifaceted challenges, such as the ongoing dependence on fossil fuels, existing infrastructure based on these resources, short-term economic obstacles, and difficulties in high-carbon sectors, as is the case with the mining sector. Additionally, there is the challenge of meeting the demand for advanced clean technologies.

In this perspective, Accenture conducted a research report on Brazil’s leadership in decarbonizing the mining sector and highlights the trajectory of mining companies toward emissions neutrality.

Below, we present a comprehensive summary prepared by Accenture’s experts. Enjoy the read!

Currently, Brazil stands out with 85% of its electricity coming from renewable sources, a value three times higher than the global average of 27%¹. Furthermore, there are prospects for further increases in this index in the coming years.

This places the challenges and opportunities of decarbonization in Brazil in a different scenario compared to global challenges. An additional favorable factor is the lower geopolitical complexity regarding energy supply in the country.

Consequently, decarbonization initiatives in Brazil differ from global initiatives, which primarily focus on reducing or eliminating fossil fuel or coal-based energy sources. Brazilian mining companies concentrate their efforts on achieving greater energy efficiency in their operations.

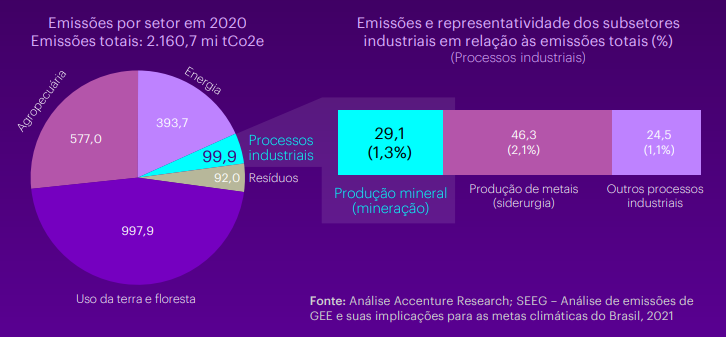

When it comes to their carbon emissions footprint, the mining industry exerts significant influence, contributing 29% of emissions among industrial processes and representing 1.3% of Brazil’s total emissions (as illustrated in Figure 1).

This scenario favors the leadership position and impact of Brazilian mining companies in seeking innovative initiatives to promote decarbonization and achieve emissions neutrality goals by 2030.

Competitive Potential and Readiness for New Market Requirements

With the likely approval of the Carbon Border Adjustment Mechanism (CBAM) by the European Union, which will involve taxing based on greenhouse gas (GHG) emissions in the production of imported goods, Brazil faces the prospect of new market requirements.

The country, holding vast mineral reserves and a prominent position in the production and export of these resources, has a strong motivation to adapt to the current and future demands of this market.

Furthermore, Brazil’s predominantly renewable energy matrix provides a competitive advantage, positioning the country at the forefront of the pursuit of more sustainable mining.

Experts point out that these conditions make Brazil highly attractive for investments and a potential leader in the global decarbonization process.

How are Greenhouse Gas Emissions (GEE) classified in mining?

GHG emissions in the mining industry are classified into three distinct scopes:

Scope 1 (Direct Emissions):

- Emissions from the extraction of fossil fuels.

- Emissions generated by the generation of energy used in mining operations.

- Emissions resulting from the production of mining raw materials.

- Emissions from company-owned facilities and buildings.

- Emissions from operational vehicles and equipment.

Scope 2 (Indirect Emissions):

- Emissions related to the acquisition and consumption of energy for operations.

- Emissions from the generation of energy used in operations.

Scope 3 (Other Indirect Emissions):

- Indirect emissions from controlled sources in operations.

- Emissions from the final disposal and treatment of sold products.

- Emissions from the transportation and distribution of mining products (both downstream and upstream).

- Emissions generated by employee commuting and business travel.

- Emissions associated with the processing and use of mineral products.

- Emissions from subsidiaries and leased assets.

- Emissions resulting from the transportation of raw materials from production points (mines) to seaport terminals via railways.

This comprehensive classification of emission scopes in mining highlights the importance of evaluating not only direct emissions but also indirect emissions throughout the industry’s entire value chain.

Investor Research Insights

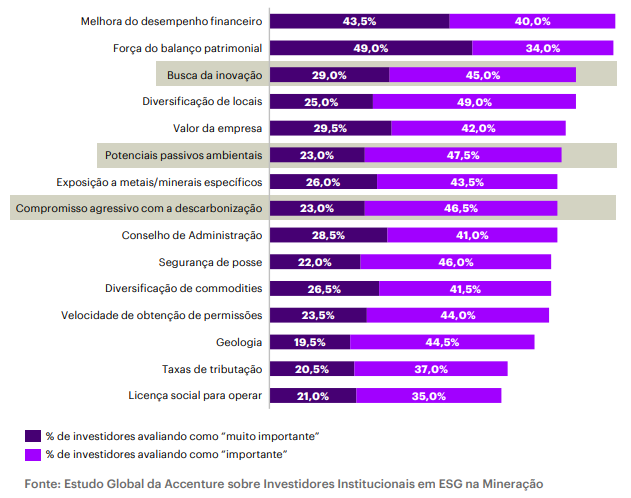

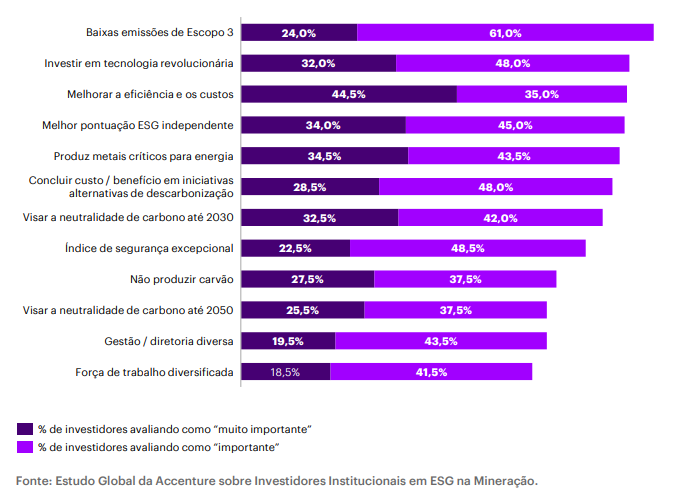

Investor research reveals that while financial criteria remain of utmost importance, such as improving financial performance and balance sheet strength, classified as “important” and “very important” by 83.5% and 83.0% of respondents, respectively (Figure 2), decarbonization-related criteria are gaining increasing relevance in investors’ capital allocation.

Innovation, concerns about potential environmental liabilities, and a strong commitment to decarbonization are considered “important” and “very important” by 74%, 71%, and 70% of respondents, respectively.

This interpretation indicates that investors are urging mining companies to adopt aggressive approaches towards decarbonization while simultaneously delivering strong financial results, either through revenue growth or capital cost reduction.

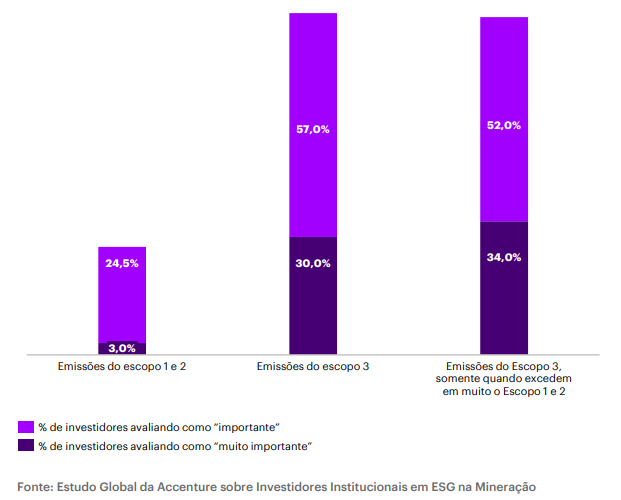

Regarding sustainability initiatives, Scope 3 emissions, which are generated by the purchasers of mining products, stand out as the most relevant assessment factor for investors (Figure 3).

Furthermore, when asked about the relative importance of Scope 1, Scope 2, and Scope 3 emissions, the research reveals that Scope 3 emissions are valued at over three times more than Scope 1 and 2 emissions, even when these emissions may not be substantial (Figure 4).

This scenario underscores the increasing importance of supply chains and extended responsibility in mining companies’ sustainability and decarbonization strategies, reflecting the need to consider not only direct emissions but also indirect emissions throughout the entire value chain.

Decarbonization Initiatives Driving Value for Shareholders

The incorporation of advanced technologies, such as data analytics, artificial intelligence (AI), and blockchain, has the potential to enhance operational efficiency in mining operations, resulting in increased revenues and profits. It is essential to highlight that these technologies will play a central role in achieving and monitoring decarbonization performance.

As a result, it is plausible to expect that digital transformation projects will be well-received not only by investors but also by other stakeholders involved.

As noted earlier, the study points out that investors view emerging technologies and digital transformation as the best opportunities to enhance the value of mining companies.

Thus, as companies embark on the journey toward net-zero emissions targets, three fundamental strategies guide the implementation of initiatives:

- Operation Optimization (Efficiency Improvements aimed at reducing energy consumption)

- Electrification of Consumption (Substitution of fossil fuels and adoption of electric vehicles)

- Decarbonization (Energy consumption generated exclusively by low-carbon emission technologies)

These approaches represent the pillars for reducing carbon emissions in the mining industry and increasing sustainability, which, in turn, is perceived as a catalyst for shareholder value.

Among solutions with limited benefits, experts highlight the sale of coal-related assets and the implementation of carbon capture, utilization, and storage (CCUS) technologies.

However, regardless of the chosen strategy, digital transformation plays a crucial role. Net-zero solutions supported by digital technologies can offer economically viable ways to achieve emission reductions across all sectors.

An example of this can be seen in Europe, where recent Accenture research reveals that pursuing short-term and near-term strategic opportunities will enable European companies not only to be well-positioned to achieve the ambitious goal of a 55% reduction in emissions by 2030 but also unlock approximately €28 billion in business value across six specific sectors, including chemicals, cement, iron and steel, batteries, pharmaceuticals, and data centers by 2025.

This demonstrates the potential for integrating digital technologies to drive positive outcomes from both environmental and economic perspectives.

And how should Brazilian mining companies proceed?

According to Accenture, the most sensible approach involves the development of short-term initiatives that deliver quick results to build investor confidence before tackling the broader challenges of decarbonization, which, while they can have a significant impact, also come with high risks.

Furthermore, as highlighted in the study “Measuring sustainability. Creating value,” it is critically important that mining companies continue to invest in technologies that increase transparency regarding their emissions and strengthen their management capabilities.

This approach not only contributes to sustainability but also enhances investor trust and the companies’ resilience in the face of decarbonization challenges.

Final considerations

The results analyzed in the report indicate that improving a relatively low-grade iron ore product with 58% iron (Fe) by just an additional 0.5% of iron (Fe) could result in approximately a 0.75% reduction in emissions from downstream steel mills per unit of hot metal or steel produced.

Considering that Scope 3 emissions in the downstream phase for low-grade iron ore products can exceed more than 100 times the emissions from the mining company’s Scope 1 and 2 emissions, this modest yet significant reduction can represent more than the sum of the mining company’s direct Scope 1 and 2 emissions.

Furthermore, given that high-quality products already command premium prices, carbon pricing presents an opportunity to further increase this premium as buyers seek to avoid carbon levies and other penalties.

In the example mentioned earlier, where a 58% iron (Fe) iron ore product is improved to 58.5% (Fe), the premium price differential can increase by more than $1 per ton (from $5 per ton to $6 per ton – a 20% premium) if steel mills are subject to a carbon price of $100 per ton.

Essential to capturing these price premiums is the implementation of accurate and auditable carbon tracking that begins at the mine and extends throughout the entire value chain in the downstream phase.

As more mining companies adopt these practices, we can anticipate a future where metal and mineral prices will be determined based on their overall carbon footprint or sustainability score.

For example, based on a carbon price of $100 per ton, a steel producer may be willing to pay a premium of $3 per ton for 58% iron (Fe) ore with zero carbon emissions or a premium of $3.16 per ton for “green” 66% iron (Fe) ore.

However, this entirely depends on the buyer’s motivation to acquire products from environmentally sustainable operations, which may be driven by carbon pricing or end-consumer pressures.

Progress in this direction can transform how metal and mineral prices are determined, taking into account not only the product quality but also its environmental impact.

Based on the analyses in the study, investors identify the greatest opportunities when mining companies prioritize technology, digital transformation, and efficiency initiatives that can:

- Reduce all emissions, encompassing Scopes 1, 2, and 3.

- Improve the financial performance of companies.

- Enable reliable measurement and tracking of carbon emissions.

- Facilitate the monetization of decarbonization successes across the value chain.idade humana na abordagem dos desafios mais significativos relacionados à descarbonização que têm pela frente.

The outcome extends beyond driving environmental sustainability and also represents a source of long-term financial sustainability and evaluation.

In other words, the adoption of advanced technologies, efficiency improvements, and a focus on decarbonization not only contribute to reducing environmental impact but also strengthen the financial health of companies and their long-term evaluation, providing a dual benefit that serves both investor interests and global sustainability. Concludes Accenture.

About the Study

This study is based on Accenture’s Global Institutional Investor Research on ESG in Mining, which surveyed decision-makers in 200 public and private institutional investment companies with mining assets in their portfolios valued at approximately $847 billion as of June 2021.

The companies were primarily headquartered in Australia, Canada, Hong Kong, New Zealand, Singapore, South Africa, the UK, and the US. The aim was to understand the impact of environmental, social, and governance (ESG) factors on investment decisions.

The global survey was conducted in 2021, before the invasion of Ukraine by Russia in February 2022. There is a risk that investor sentiment regarding ESG initiatives may have changed as a result of the invasion; however, we still believe that the survey results accurately reflect investor opinions.

References

The data presented in this report is derived from Accenture’s Global Institutional Investor Research on ESG in Mining unless otherwise indicated. Below are the specific references:

- “Matriz Energética e Elétrica”, Empresa de Pesquisa Energética, 2021.

- Peter Lacy e Jessica Long, “UNGC – Accenture Strategy CEO Study on Sustainability”, Accenture, 2019.

- Taylor Kuykendall, “Path to net-zero: Seeing climate opportunity, miners target emissions cuts”, S&P Global Market Intelligence.

- Relatório sobre Mudanças Climáticas 2021, Vale, 2021.

- “CSN vai testar tecnologia à base de hidrogênio verde”, Valor, 2022.

- Hannah Ritchie e Max Roser, “Emissions by Sector”, Our World in Data.

- Jean-Marc Ollagnier, Sytze Dijkstra e Lasse Kari, “European industries can grow with green”, Accenture.